This is my 4th post on the topic of $TSLA and never thought I would do one in 2021. My predictions was a valuation of $1T by 2030. That will come and pass rather soon.

My first post on $TSLA was back in June, 2017 where the core value long term I thought was Chemistry (Battery) and Intelligence (Full Self Driving/Autonomy). That continues to be the case with Elon’s battery day (Sep’20) & Tesla Autonomy day on April 2019.

So why $10T? That seems to be even more ridiculous than the $1T. Since Feb’20 to now it has gone by 4x and $600B market cap. While there are lots of bears, there are lots of bulls as well for the TSLA case.

Bull Case #1: The bull case is presented by Ark Invest (Source: Ark Invest). Having crossed 500K in 2020 and total of 1M+ with 2 additional factories (Austin and Berlin) yet to come online, getting to 1-2M by 2025 is highly likely and approaching 5M might be difficult, but then Elon has beaten the odds and the market is expecting him to with the demand.

| 2020 | Example Bear Case 2025 | ||

|---|---|---|---|

| Cars Sold (millions) | 0.5 | 5 | Example Bull Case 10 |

| Average Selling Price (ASP) | $50,000 | $45,000 | $36,000 |

| Electric Vehicle Revenue (billions) | $26 | $234 | $367 |

| Insurance Revenue (billions) | Not Disclosed | $23 | $6 |

| Human-Driven Ride-Hail Revenue (net, billions) | $0 | $42 | $0 |

| Autonomous Ride-Hail Revenue (net, billions) | $0 | $0 | $327 |

| Electric Vehicle Gross Margin (ex-credits) | 21% | 40% | 25% |

| Total Gross Margin | 21% | 43% | 50% |

| Total EBITDA Margin* | 14% | 31% | 30% |

| Enterprise Value/EBITDA | 162 | 14 | 18 |

| Market Cap (billions) | 673 | $1,500 | $4,000 |

| Share Price** | $700 | $1,500 | $4,000 |

| Free Cash Flow Yield | 0.4% | 5% | 4.2% |

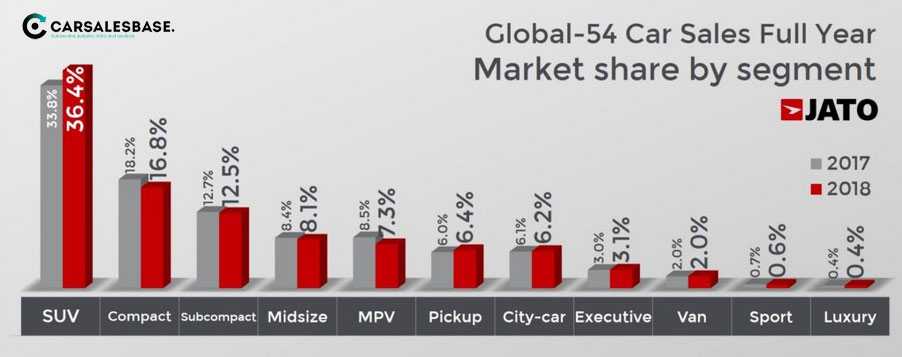

What’s interesting is TSLA has single-handely taken out the $35K- $100K market which the Germans dominate and Toyota tried hard to penetrate with incremental engineering and marketing. TSLA changed the game and will perhaps go as low as $25K but not lower is my guess. TSLA will license IP (Chemistry and Intelligence) and let others make the cars. The entire $35K to $100K is now ‘owned’ by TSLA and its going to be harder for most makers other than the BMW or Mercedes and they will be supported by ardent fans latched onto the brands. 2018 data for segmentation of the various categories is shown here.

Source: https://carsalesbase.com/global-car-sales-2018/

As you can see from above, 62.8% of the market will be covered by Tesla with Model 3, Model Y, Model S, Cybertruck and perhaps upcoming new China sourced $25K model. That includes the SUV, Midsize, MPV, Pickup, Executive, Sport and Luxury segments. The total market size is 54M cars and if Tesla can get 20% of that category – which actually is possible (we are in winner take all world these days with Amazon, Google, Apple where its tech driven) relative to conventional wisdom of highly fragmented and splintered market for automobiles.

Bull Case #2: Its what I mentioned in the last year. One has to look at TSLA as a business of businesses. Expect in the next 5 years, either take the Alphabet (GOOG) route or via other routes (Spin-offs, M&As, SPACs ….) derivative businesses will emerge and stand on their own. To re-cap

- A car company

- A Battery company at planet scale

- An AI/ML company (machine vision in particular)

- An electric storage company

- An Electric Utility company (low value but at scale gets interesting)

- An energy distribution company

- A potential Cloud or computer company (if a book store turns into cloud computing, an autonomous car can have the right assets for becoming a cloud company)

- A big data/mapping/navigation company

- A carless car company (i.e. Uber/Lyft killer robotaxi)

- A machine vision driven robotics company

- and more to come….(more than letters in the Alphabet)

Elon himself quoted a version of this back in Oct’2020

Bull Case #3: Chemistry and Intelligence. Every tech category goes through vertical integration and horizontal stratification. I speculate Elon will build down to a $25K car and below that, he will ‘license’ IP (Chemistry and Intelligence or battery tech and autonomy tech) to get worldwide reach. It would not make sense to have factories all over the world for all geos – but a strong IP revenue model ($1-$2K/car) could be had and also enable new players in countries to become car companies – i.e. more local manufacturing and distribution. And not just limited to cars, for all kinds of transportation and perhaps energy sectors. From the chart above the remaining 35% of the segments (Compact, Sub-Compact, City-car) would belong in this category. Of the 86M cars sold in 2018 (I suspect its less in 2021), 30M cars would be in this category. If 20% of the manufacturers pay TSLA $1K-$2K – lets assume $1K – that is $6B of pure profits which is subsidized by the higher end. The TSLA brand will be more valuable and trusted over VW, Mercedes, BMW, Toyota by 2025 that most people would buy a car ‘Tesla powered’. At this rate of battery cost decline (see blow), these manufacturers who cannot afford R&D or manufacturing at scale would do well to buy it off TSLA. This is akin to INTC holding onto x86 and not having an IP model which let ARM into its turf. Imagine if INTC had both a vertically integrated model of CPUs and a licensing model for some components – AAPL would be in Intel’s camp and so would the big three hyperscalers. Pat Gelsinger is trying to get Intel back into that game in 2021 (which we will address in a different blog post). But if TSLA were to choose both models, a vertically integrated model for some categories and an IP or sub-component sale to other categories, they can cover the entire spectrum and make the brand even more ubiquitous and higher moat.

TSLA is handicapped relative to VW and Toyota on manufacturing scale and distribution reach. The aggressive ramp of manufacturing of the car and IP model will broaden the reach and create other businesses (Robo Taxi, Energy Storage/distribution, Cloud computing for AI and many more to come).

Bill Gates famouly said ” We overestimate what we can do in 2 years and underestimate what humanity will achieve in 10″. One has to do a version for Elon. He over-promises what’s coming in 2-3 years, but delivers on a 10 year vision. If you look back what he has said in 2011/2012 – and see what has been accomplished – its not that far off.

We will revisit this blog in 2025 if we have crossed the Ark Invest marker and if TSLA is barrelling past $3-$4T and march towards the first $10T company on the planet (or maybe a collection of companies).